Last December, Dominion Energy filed their latest DSM application (Phase XII) with the State Corporation Commission. The company is proposing four new programs and seeks to modify two current programs. The VAEEC is a respondent in the case, with our Executive Director, Chelsea Harnish, providing expert testimony..

The four new programs are: Residential New Construction (EE), Residential Smart Thermostat Purchase (EE), Residential Smart Thermostat (DR), and Non-residential New Construction (EE). They also requested to update the eligibility criteria for the Phase VIII Small Business Improvement Enhanced Program to allow for businesses with more than five locations to participate, and to change the Phase VIII Non-residential Energy Efficiency Midstream Program to offer more up-to-date program measures, such as ice makers and dishwashers.

We fully support Dominion’s application. However, we identified several areas for continued improvement

Support for the Phase XII Filing as Necessary but not Sufficient to Meet VCEA targets

The programs and alterations proposed are necessary steps for Dominion to achieve their energy efficiency goals. However, it is still very unlikely that they will go far enough to meet the VCEA EERS targets. Chelsea said in her testimony, “Since this filing is the last opportunity for the Company to propose new programs before the end of 2025, it will need to deploy other resources including: increasing participation rates, utilizing Commission approved, portfolio level marketing funds to increase consumer awareness, and do more to leverage the functionalities of Advanced Metering Infrastructure or AMI.”

Dominion will also need to launch all of its previously approved programs to start accumulating the energy savings needed to meet the VCEA targets, as well as continuing to utilize the stakeholder group to build out implementation plans for the four key recommendations from the Hearing Examiner’s Report. As it currently stands, and depending on the metric used, Dominion will only achieve 3.2% savings in 2024 and 3.7% in 2025, which are significantly short of the mandated 3.75% and 5%, respectively. However, it is critical that the SCC does not address this shortfall by reducing the EE targets – meeting the targets that were adopted in the VCEA, and continuing to mandate stronger goals, are critical to promoting an energy-efficient economy, combating climate change, and providing a safe and healthy environment for all Virginians.

In regards to the New Residential Home Construction Program, we raised concerns about the version being utilized in the program. The Dominion program only requires that new homes are built to Energy STAR 3.1 standards, however, the standard was recently updated to 3.2, which is required for home builders to receive the federal 45L tax credit. Since it has been confirmed by EPA that homes built to 3.2 do meet the standards in 3.1, we asked the Commission to ensure that Dominion allows homebuilders building to version 3.2 can also participate in their program.

Analysis of the Long-Term Plan, Project Management Report

In late 2022. Dominion released a long-term plan (LTP) outlining how the company would meet the energy savings goals in the VCEA. In last year’s filing, the company did not provide specific metrics or quantifiable data on tracking this progress so the Commission recommended they include an LTP Progress Report with this year’s filing. Unfortunately, the report in the current filing continues to be vague while also reporting that the company is making “considerable progress” on the recommendations set forth in the LTP. We provided examples of metrics the company issued in interrogatories, as well as the EE stakeholder group, and asked the Commission to explicitly require quantifiable metrics in future filings so that stakeholders can better assess the true progress that is being made towards the VCEA goals.

Review of Cost-Effectiveness Test Results

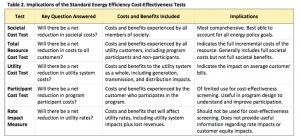

Virginia law requires proposed utility EE programs to pass three out of a possible four cost-effectiveness tests in order to be approved by the SCC. These four tests are:

- Participant Cost Test

- Utility Cost

- Total Resource Cost and

- Ratepayer Impact Measure (“RIM”)

These tests were designed in the 1980s and do not take into account any of the technologies or modernizations of the intervening decades. Moreover, the tests vary widely from state-to-state or even program-to-program, with the inputs heavily weighted towards the costs to the utility without considering many of the benefits.

As our members are likely aware, the VAEEC formally supported the SAVE Act in the 2024 General Assembly Session, which requires the Commission to develop a single cost-benefit test following the guiding principles of the National Standard Practice Manual (NSPM). The Governor added an amendment, which will also require the utilities to perform the TRC test in addition to the new test. While this amendment is not perfect, there are opportunities to address the issues this could raise before the new test is implemented in 2029. On April 17th, the General Assembly reconvened for “veto session,” and formally accepted this amendment.

Adopting a new cost-effectiveness test following the guiding principles of the NSPM would ensure that all investor-owned utilities in Virginia are using the same inputs in a transparent and balanced analysis that is forward-looking and aligns with the energy policy goals of the Commonwealth.

Discussion of Net/Gross Savings Metrics

The VCEA codifies “total annual energy savings” as the method-of-choice for determining energy savings, which includes savings from both new measures installed in a given program year, as well as measures installed in previous years that are still actively providing energy savings.

However, there has been an ongoing debate on whether the utilities can use net or gross savings to meet the VCEA targets. Dominion and SCC staff say the utilities should be able to use gross savings while environmental experts state that only net savings should be counted. While the VAEEC does not have a position on this issue, we felt compelled to weigh in this year when the company provided definitions for the two terms that do not align with industry standards.

Gross savings are the difference in energy consumption based on the savings from a particular measure or project vs the baseline consumption without that measure in place – and net savings, is essentially gross savings minus “free riders,”- or customers who would have installed the measure without participation in a utility program, per the EPA Guidebook for Energy Efficiency Evaluation, Measurement, and Verification.

In simpler terms, gross savings are calculated as the energy savings attributable to a particular measure—for instance, by comparing the energy usage of a high-efficiency dishwasher to the energy usage of the ordinary dishwasher it replaced.

In Dominion’s Legal Memorandum on the matter, the company stated the difference was related to whether or not the savings were from a program or specific measure.

“Simply stated, gross savings are the savings from the energy efficiency measure (e.g., savings from a high efficiency light bulb or air conditioner upgrade) while net savings are the savings from the energy efficiency program (e.g., the Residential Home Energy Assessment Program or Non-residential Heating and Cooling Efficiency Program).” Not only is this not an industry-recognized definition, but it is also contradictory to the technical reference materials used in Dominion’s own 2023 EM&V report.

When considering whether to use gross or net savings to calculate progress towards the VCEA goals, the SCC will need to rely on correct definitions cited in industry standard manuals.

Last December, Dominion filed an application with the State Corporation Commission (SCC) for its proposed Phase XI DSM programs. This filing included three new energy efficiency programs, four new EE program “bundles,” one demand response program, and one EV telematics pilot program. The company requested a $149M budget cap with a 15% variance. In addition to the new programs, Dominion asked to permanently close its appliance recycling program and expand its agricultural program to residential customers who run small, family farms. The Company requested to close an additional seven other programs whose measures were being rolled into the proposed program bundles.

Our Executive Director, Chelsea Harnish, filed testimony on behalf of the Virginia Energy Efficiency Council (VAEEC) in support of the Phase XI programs with a few concerns and suggestions for improvement.

Here is a summary of other highlights from our testimony:

- Leveraging functionalities of AMI to enhance the effectiveness of DSM programs

- Expanding program offerings to dual-fuel customers (those with gas heat and electric AC)

- Quantifying whether funding from the Inflation Reduction Act could lower program costs

- Including Non-Energy Benefits (e.g., Social Cost of Carbon) in cost/benefit test scores

- Requiring BPI certification for the Residential Home Retrofit Program Bundle

On May 17, 2023, the case was heard before the Hearing Examiner assigned to oversee the case. The Examiner was very supportive of the stakeholder process and stated several times that parties were “on notice” to vet new program ideas and areas of concern through the stakeholder process. This is the first time that a Hearing Examiner has put such an emphasis on the value of the stakeholder process. We hope the Commission’s Final Order reflects this same sentiment.

Meeting the Goals of the Virginia Clean Economy Act

As part of the application, company witnesses shared the progress towards meeting the Energy Efficiency Resource Standard (EERS) goals of the Virginia Clean Economy Act (VCEA). According to Dominion, the Commission has not made it clear whether they should calculate Gross savings (all savings achieved in a given year) or Net savings (all savings achieved in a given year minus free riders), so they provided calculated savings for both. As seen in the table below, provided by company witness Nate Frost, the company has met the 2022 goal either way but is only able to achieve the 2023 goal with gross savings calculations. For the 2024 and 2025 goals, the company is projected to not meet either goal under either scenario.

| Year |

VCEA Target % |

MWh savings |

Projected/ Actual Gross Savings |

Projected/ Actual Net Savings |

| 2022 |

1.25% |

852,892 MWh |

1.9% |

1.4% |

| 2023 |

2.5% |

1,705,783 MWh |

2.6% |

2.1% |

| 2024 |

3.75% |

2,558,675 MWh |

3.1% |

2.4% |

| 2025 |

5% |

3,411,567 MWh |

3.6% |

2.9% |

In pre-filed testimony, SCC staff witness Andrew Boehnlein noted that Dominion will have a projected shortfall of 1180 GWh in meeting the 2025 energy-savings goal. Mr. Boehnlein also calculated that the proposed Phase XI programs would only cover 5% of the shortfall in 2024 and 7% in 2025. Given that there are no further opportunities for new programs in 2024, the company must prioritize implementing recommendations from its long-term plan filed as part of last year’s filing (Phase X) to bridge the gap in 2024.

Company witnesses identified several market barriers they believe are impeding the company’s success in meeting its goals. These challenges include declining potential and updated building codes. The VAEEC questioned the extent to which these were barriers during the proceeding. For instance, current building codes should only be used as the baseline for determining the savings potential for new construction programs since it is unlikely that homes constructed prior to the last 3-5 years would meet more stringent energy codes. In interrogatories, company witnesses confirmed they only use current building codes for new construction programs. Since the company only has one residential new construction program, current energy-efficient building codes are unlikely to severely affect the company’s ability to meet its EERS goals.

All utilities experience declining potential, the continual reduction of savings opportunities out in the market, especially for lighting products as federal regulations have required more efficient product manufacturing. However, declining potential is not the same for every utility. Utilities that have been implementing programs over several decades find that declining potential can severely affect new program opportunities. However, for Dominion, who only began offering energy efficiency programs in 2009, and has low participation numbers in most of their programs, there is still a lot of potential energy savings to be captured.

As mentioned, Dominion’s participation numbers are low. SCC staff witness Mr. Boehnlein summarized data from the Company’s 2022 EM&V report. In 2021, the average residential program achieved approximately 45% of expected participation and 57% of estimated energy savings. For the non-residential programs, the average was 43% of expected participation and 32% of estimated 2021 savings. Staff surmised that based on previous program performance, the Company’s projected participation rates for the proposed Phase XI programs are higher than any program that has been implemented to date. In other words, the proposed programs will cover less than 5% of the estimated shortfall in 2024 and 7% in 2025.

Mr. Boehnlein also noted that the 2022 EM&V report stated portfolio bill savings for customers were approximately $26.6M while program costs were more than double at about $59.8M with 43% of those costs being administrative in nature.

Hearing Examiner’s Report and Recommendations

On June 16, 2023, the Examiner issued his recommendations to the Commission, which included approval of all programs, with the $149M budget cap and 15% variance, with no program expiration date. While the budget variance request and not having a predetermined closure date are standard in other states, in Virginia, these requests were typically denied by the SCC up until last year.

The Hearing Examiner was thorough in his review of the case and analyzed all of the remaining issues one by one. In most instances, the Examiner validated suggestions and concerns brought up by the VAEEC and recommended the SCC direct the company to address each one via the stakeholder group and require the company to report on these issues in their next DSM filing. These issues include:

- Cost-effectiveness testing: VAEEC recommended analyzing non-energy benefits, such as the societal cost of carbon and health benefits

- Allowing dual-fuel customers to participate in most programs: VAEEC recommended allowing customers who use gas furnaces to heat their homes and electric AC to keep their homes cool should be allowed to participate in most, if not all, programs. The Examiner not only recommended this become a stakeholder discussion but also noted that if the company is projected to miss their 2024 and 2025 VCEA goals, then expanding customer eligibility could have an “immediate and measurable impact on achieving those savings targets….”

- Accelerating program consolidation: In last year’s filing, VAEEC expressed concern with the Company’s plan to not begin bundling programs until existing contracts with implementation vendors end (i.e. 2025 at the earliest). The company took this feedback and offered four new bundled programs in this year’s filing. Other respondents expressed the need to continue bundling programs into the seven overarching programs laid out in the long-term plan, which the company agreed to discuss where practical. The Hearing Examiner agreed that acceleration was critical in order to pursue, “immediate and measurable impact on achieving those savings targets….” in 2024 and 2025.

- Exploring and incorporating full AMI functionality into DSM programs: VAEEC recommended the company leverage AMI functionality in DSM programs. The company is committed to exploring these functionalities via its grid modernization applications. The Examiner noted what little time is left to increase participation levels and savings in the company’s DSM programs to achieve their 2024 and 2025 goals, stating, “I believe the Company does not have the time to sit back and address the issue as part of its grid transformation program, and for that reason, I am recommending that the issue be referred to the Stakeholder Group for consideration and analysis over the upcoming year.” The Examiner also went on to recommend a pilot program to deploy in areas with high concentrations of AMI deployment.

Additionally, the Hearing Examiner made recommendations on the following key issues as well:

- BPI certification- The Hearing Examiner provided an alternative recommendation to what the VAEEC, the environmental respondents, and public witnesses recommended. He recommends that BPI certification should not be required for HVAC measures, but appears to require this certification for contractors performing ductwork in addition to continuing to require BPI certification for thermal envelope measures. In terms of the VA Residential Energy Building Analyst License, the examiner stated that the statute is clear that this license is required for any type of residential energy assessment and suggested the company consult with the VA Department of Professional and Occupational Regulation in regards to whether such license would be required for contractors performing assessments as part of the Residential Home Retrofit Bundle.

- Implementation plan- the environmental respondent witness, Jim Grevatt, recommended the Commission require Dominion to demonstrate how it could meet its EERS goals by filing an implementation plan within 90 days of the release of the Commission’s Final Order. The Hearing Examiner largely agreed with Mr. Grevatt but provided an alternative recommendation suggesting the Commission require Dominion to prepare a Project Management Plan and Risk Management Strategy consistent with the Commission’s Final Order in the 2020 DSM Case detailing completed tasks, tasks to be completed within the next twelve months, and tasks that remain to be completed in order to fully implement the LTP.

- Net vs. Gross calculated savings- Environmental Respondents and Dominion argued over how the EERS goals in the VCEA should be calculated- as either “gross” or “net” savings. In Mr. Grevatt’s testimony, on behalf of the environmental respondents, he argued that the Commission provided direction on this in the Final Order last year stating that, “specific savings that can be reasonably identified, and that were not achieved as a result of Dominion’s programs and measures,” should not be counted towards the EERS goals (i.e. the savings should be calculated as “net”). Dominion disagreed, arguing that the ruling was not clear and that the analysis of “gross” and “net” savings is complex and should be deferred until the first EERS compliance case next year. While the Hearing Examiner agreed with environmental respondents that the Commission explicitly state that the EERS savings should be calculated as “net” savings, he also agreed with the Company that in light of the complexity of the issue, the decision should be deferred until next year, “in a case where the issues are fully developed in an evidentiary record.”

In summary, the Hearing Examiner’s report details a lot of issues and opportunities for Dominion to meet its EERS goals in 2024 and 2025. The VAEEC and our members have worked diligently to provide feedback and support through the stakeholder process and the DSM proceeding and applaud the Examiner for recognizing the importance of stakeholder engagement.

We anticipate the Commission’s Final Order sometime in August. We hope to see most of these recommendations included and we will be ready to get to work.

A new program launched by Dominion Energy provides a kit of smart home technology with an instant rebate to eligible customers in Virginia.

New Smart Home technology helps customers save energy and be more aware of the electric use in their home. To help customers adopt this new technology, Dominion Energy is offering eligible customers in Virginia as well as North Carolina rebates on smart home products.

The Smart Home program gives customers the opportunity to purchase a smart home kit on the program website, smarthome.domsavings.com, with an instant $25 rebate. The base kit includes a Kasa Smart Plug with Energy Monitoring, two Kasa Smart Wi-Fi Plug Minis, the Philips Hue Smart White Ambiance LED Starter Kit and a Philips Hue Motion Sensor.

Customers can enhance their smart home setup by adding an ecobee Smart Thermostat ($50 rebate) or Sense Home Energy Monitor ($70 rebate) to their kit purchase, and each is available with an additional instant rebate. The Sense Energy Monitor must be installed in your electric panel by a licensed electrician.

As such, electricians as well as solar installers with on-staff licensed electricians can become participating contractors with Dominion’s Smart Home Program. Participating contractors benefit from the program in many ways including getting listed on Dominion’s website and access to free training. To learn more about becoming a participating contractor including the eligibility requirements, visit www.dom-vendor.com.

As such, electricians as well as solar installers with on-staff licensed electricians can become participating contractors with Dominion’s Smart Home Program. Participating contractors benefit from the program in many ways including getting listed on Dominion’s website and access to free training. To learn more about becoming a participating contractor including the eligibility requirements, visit www.dom-vendor.com.

With integration between smart home devices and a smartphone and / or voice assistant, customers will have increased control over their home’s energy use, even remotely. Customers will have the ability to put your devices on a schedule, allow devices to perform energy-efficient actions on their own, and connect to other smart technologies.

Learn more about how the program helps customers leverage integrated energy-efficient smart home products to reduce and manage a home’s energy consumption. Visit smarthome.domsavings.com for more information. Terms and Conditions and eligibility requirements apply. Subject to change at any time.

Dominion’s Energy Efficiency Stakeholder Group met virtually on August 27th. They discussed a number of updates, as well as brainstormed ideas for long-term planning.

The Virginia Clean Economy Act included some changes to the stakeholder process, so two new subgroups were created, focusing on Policy and EM&V. Those groups will meet in the coming weeks.

Additionally, Dominion provided an update on how the COVID-19 pandemic has affected their DSM programs as well as an update on the improved eligibility definition for low-income programs, which we worked to change earlier this year. While the marketplace has been open the entire time, all in-person programs were suspended last spring. Dominion resumed their Non-Residential programs on May 15th and resumed all of their single-family, residential programs in June. Recently, they allowed multi-family projects to resume in their low-income programs. All low-income program providers are following federal weatherization COVID guidelines.

Following the SCC’s recent approval of all of Dominion’s Phase VIII DSM programs, the Dominion DSM team and their implementation vendors are working on preparation as they prepare to launch them in January 2021.

Dominion also provided an update on their next filing for Phase IX, which will be submitted to the SCC in December. The company received 53 program proposals from ten vendors in response to their most recent RFP. The program categories were: Non-Residential, Residential, Low-Income, Cross Program services (e.g. marketing, call center, rebate fulfillment, etc.) and “open” programs with this last category being used as a starting point for next year’s RFP.

Dominion’s EM&V vendor, DNV GL, gave a presentation on their annual EM&V report, which was filed back in May. The residential marketplace made up 51% of the energy savings from DSM programs in 2019. Through the marketplace program, 3.5 million light bulbs were purchased either online or at a retail store. The Non-Residential lighting program made up 30% of the energy savings in 2019 and the Non-Residential small business program made up 11%. All other programs each made up one percent or less of the total savings accrued in 2019. There was also a brief discussion about the upcoming EM&V proceeding before the SCC, which will take place next May. The VAEEC will be participating as a respondent in this case and has already begun working with our lawyers with the UVA Environmental and Regulatory Law Clinic in preparation.

The group concluded the day with a discussion on long-term planning. The company has hired the Cadmus Group to assist with this planning, which will help meet their mandated energy savings targets, which became law earlier this year. If you are already a member of the stakeholder group, and would like to participate in this planning process, be sure to add yourself to the long-term planning subgroup in Trello.

If you would like to participate in the Stakeholder meetings or would like to view materials, please email the meeting facilitator, Ted Knicker at ted.knicker@ipa-llc.org to learn more.

Yesterday, the SCC approved ALL of Dominion’s Demand Side Management (DSM) programs in their phase VIII filing and the updated programs in their VII filing. All programs- except the Low Income (LI) heating and cooling program- were approved for five years from January 2021-December 2025. The LI heating and cooling program was approved for three years, as stated by law, and will run from January 2021-December 2023. The updated phase VII programs can begin immediately and will end in December 2024 along with the remaining VII programs.

As a formal respondent in the proceedings, the Virginia Energy Efficiency Council (VAEEC) is incredibly excited with the progress shown in this final order. The Commission has also expressly agreed with the VAEEC that the creation of a standardized dashboard for evaluation, measurement, and verification (EM&V) reporting is necessary to determine the true effectiveness of these energy efficiency programs.

The Commission also agreed that the proposed mid-stream program should not split the incentives between the homeowners and the builders. This is a great example of how our involvement in this process is crucial. The company had agreed to the 50% split incentive in their rebuttal testimony and the Hearing Examiner recommended it to the Commission. However, the Commissioners were clearly swayed by our arguments that a split incentive did not enhance energy efficiency gains in this instance.

We’re also pleased to note that Dominion has expressed its willingness to continue working on standardizing the process for qualifying low-income projects and post-construction reporting requirements. The updated eligibility criteria that Dominion agreed to earlier this week are part of this work, though there are standardization needs that still need to be addressed.

A full list of the programs can be found here.

On June 16, 2020, the hearing examiner in the Dominion Energy DSM Proceeding (PUR-2019-00201) released his recommendations to the Commission. Overall, the report was positive, recommending that all of the programs be approved- some with modifications- at the budget requested by the company.

While the VAEEC is pleased overall with the recommendations, we are drafting comments as respondents in the case to address two outstanding issues:

- For the New Home Construction program, the hearing examiner recommends splitting the incentive between the homebuilder and the homebuyer 50/50. As we argued in our post-hearing brief, the lead actor for creating market transformation in this type of mid-stream program is the homebuilder, “who is making the design and equipment decisions necessary to achieve ENERGY STAR certification, [which] leads to more energy-efficient homes being put on the market for sale.”

- The hearing examiner stated that the VAEEC’s request to require that all future DSM applications include energy savings data and tracking metrics towards the goal in the Virginia Clean Economy Act (VCEA) was unnecessary. Instead, it was suggested that this and all other futuristic recommendations should be further explored and developed by the stakeholder group. While we do agree with this conclusion for some of our other recommendations (e.g. geo-targeting and using AMI to enhance programming options), we feel the Commission should require inclusion of key data- as related to the mandates in the VCEA- in all future filings. Without these metrics, how can the Commission and the public understand whether or not the company is making progress towards its goals?

We hope the Commission will consider these arguments as they deliberate on their decision.

One final thing to note is the section of the hearing examiner’s report on EM&V. Throughout the proceeding, the SCC staff expressed a lack of confidence in the company’s EM&V analysis. In the company’s rebuttal testimony, Mimi Goldberg with DNV GL invited Staff to meet with them in order to walk through their process and to “improve the rigor of EM&V.” During their opening statements at the virtual hearing on April 29th, the SCC staff attorney took offense to this suggestion, which they reaffirmed in their post-hearing brief, stating, “such collaboration between [Dominion Energy] and Staff would compromise Staff’s ability to critically review future DSM filings.”

In his report, the hearing examiner not only dismissed this notion of impropriety, but made the recommendation for the Commission to direct Staff to engage with the company on these issues. The recommendation also goes on to reaffirm SCC staff’s engagement in the stakeholder processes, which to date has been greatly limited.

From the hearing examiner’s report:

“Moreover, Staff working with the Company to develop more rigorous and accurate EM&V data is consistent with the requirements of § 56-596.2 C of the Code as revised by the VCEA. This Code provision directs the Company to use a stakeholder process “to provide input and feedback on . . . (iv) best practices for [EM&V] for purposes of assessing compliance with the total annual energy savings . . . .” This Code provision further provides: “[s]uch stakeholder process shall include the participation of representatives from each utility, relevant directors, deputy directors, and staff members of the Commission who participate in approval and oversight of utility efficiency programs, . . . .” I recognize that Staff working with the Company to develop more rigorous and accurate EM&V data may go beyond the requirements of the stakeholder process set forth in § 56-596.2 C. However, Staff participating in the stakeholder process addressing EM&V, but declining to otherwise work with the Company on EM&V issues, would undermine the policy directive of the General Assembly for EM&V practices to be developed in a collaborative process. Therefore, I find the Commission should direct Staff to work with the Company and others to develop more rigorous and accurate EM&V data.”

So, what are the next steps? We wait for the SCC to issue their Final Order in the case, which should happen within the next several weeks. Regardless, Dominion’s plan is to launch the approved programs in early 2021. The next virtual stakeholder meeting is anticipated to be held sometime in August.

The Dominion DSM case was held Wednesday, March 20, 2019 before the three Commissioners of the State Corporation Commission (SCC). This was the first case being heard by the new Commissioner, Judge Patricia West. Our previous blog post on the DSM application went into detail about the programs themselves so this post will only focus on the proceeding. You can review all proceeding materials on the SCC webpage for this docket.

The Dominion DSM case was held Wednesday, March 20, 2019 before the three Commissioners of the State Corporation Commission (SCC). This was the first case being heard by the new Commissioner, Judge Patricia West. Our previous blog post on the DSM application went into detail about the programs themselves so this post will only focus on the proceeding. You can review all proceeding materials on the SCC webpage for this docket.

The proceeding was broken up into three main sections:

- Public Testimony

- Oral Arguments on Legal Memo

- DSM Proceeding

Oral Arguments

At the beginning of the proceeding, the Commissioners heard oral arguments on whether or not lost revenues should be considered as part of Dominion Energy’s commitment to propose $870M worth of energy efficiency programs over the next ten years, as part of the 2018 Grid Transformation and Security Act. Counsel for VAEEC reiterated the position, as stated in our legal brief, that lost revenues should not count towards the $870M, since the the statute that states this commitment does not mention lost revenues. Walmart, environmental respondents and the SCC staff agreed with our arguments. In addition, while the Attorney General’s office took no official position, they did mention in their oral arguments that no one- in either oral arguments or public comments (written and oral)- supported the Company’s position that lost revenues should be included in the commitment to propose $870M in energy efficiency programs over the next decade. The Commissioners asked a lot of questions during oral arguments and are anticipated to make a ruling on this issue in their Final Order for the DSM proceeding.

DSM Proceeding

During the proceeding, VAEEC, environmental respondents (Appalachian Voices and Natural Resources Defense Council), and Sierra Club supported all ten of the proposed EE programs (11 demand response programs in total). The SCC staff and the AG’s office were “unopposed” to seven programs and had “remaining concerns” about the other four.

During the hearing Dominion Energy staff stated that due to a calculation error regarding higher-than-expected participation rates for the Residential Engagement program, the Company had reduced their overall budget request to $203.9M.

VAEEC witness, Rachel Gold, with the American Council for an Energy-Efficient Economy, took the stand in support of the proposed programs and explained the value of benchmarking to evaluate whether or not the target set by the General Assembly- for Dominion Energy to propose $870 million in energy efficiency programming over the next decade- is achievable. The good news is, according to the results of that analysis done by ACEEE, this target should be easily attainable.

The seven programs with unanimous support were:

- Appliance Recycling Program

- Efficient Products Marketplace Program

- Smart Thermostat Management Program (DR)

- Smart Thermostat Management Program (EE)

- Non-Residential Window Film Program

- Non-Residential Lighting Systems & Controls Program

- Non-Residential Small Manufacturing Program

Initially, SCC staff stated that they were “unopposed” to the above programs. However, after further pressing by Commissioner Christie, SCC Staff stated that they did, in fact, support these programs. One interesting thing to note during this back and forth is that the Commissioners were expressing frustration with both Staff and the Company regarding the lack of analysis based on real energy savings. They argued that Staff should be able to take positions on proposed programs that are based on previously-approved programs since there would be real-energy savings data captured for those programs. While this data is provided by the Company in their annual EM&V filings, the Commission felt that the data could be provided in an more easy-to-digest format. Commissioner Christie directed the Company to produce a spreadsheet on previously approved programs to show the actual program costs and actual kWh savings. The Company asked for a one-week deadline to submit that table into evidence.

The inclusion of this type of table in future filings can bolster future applications by showing just how much savings are being realized by these programs, which could help win approval more easily. While the Commissioners are skeptical of energy efficiency programs and the projected savings they can achieve, that skepticism can potentially turn to support if strong energy-savings numbers are achieved in prior program iterations.

As mentioned above, SCC staff had concerns regarding the four remaining programs, which were:

- Home Energy Assessment Program: SCC staff was concerned that payout incentives were greater than material costs for individual products, which could lead to abuse. In rebuttal testimony, Dominion Energy pointed out that those assessments did not include labor costs.

- Customer Engagement Program: SCC staff were concerned about non-response rates and wanted the Company to provide traditional savings analysis for this program, which the Company did not do. An employee of the vendor took the stand to explain that behavioral programs cannot be analyzed in the way Staff was requesting, which was the reason the Company was unable to provide analysis. He then walked through how a behavioral program is assessed. According to our expert witness, Rachel Gold, who has worked for another leading company in this field, what he described is a standard practice used to evaluate these types of programs across the country.

- Non-Residential Heating and Cooling Efficiency Program: Staff’s concerns regarding this program were twofold; the TRC test score and participation rates. The Company rounded the TRC test score from 0.9965 to 1.00 in their application. Staff argued that 0.9965 was not “1” and therefore this program did not pass three of four cost tests as required by the statute. Judge Jagdman asked a clarifying question on the exact language of the statute indicating that she, at least, may be inclined to approve this program. Staff also stated they had concerns regarding the Company’s projected participation rates for the proposed program because the actual participation rates in the current program are far below the projected rates, and the new projected participation rates are even higher than the projected rates for the current program.

- Non-Residential Office Program: The issue with this program was related to the building size used in the modeling for the program. SCC staff stated that the Company was using office space of 100,000 sq. ft., which they were concerned was unrealistic and would therefore result in overstated cost-savings estimates. A Company witness from the vendor for this program testified that the program was modeled using 80,000 sq. ft. buildings, not 100,000 sq. ft., and that, 80,000sq. ft. was, in fact, a typical office building size in Dominion Energy’s service territory.

The Commission has until June 3rd to make their decision. We will be sure to let our members know the outcome once we have a chance to review the Final Order, so stay tuned for updates.

Future DSM Filings

During the hearing, VAEEC Board Member, Michael Hubbard, with Dominion Energy, announced that the Company had released their RFP for their next DSM filing the week before for 15 new programs. We have had a chance to review a summary of the RFP which includes some exciting new programs such as:

- Residential EE Retrofit

- Residential New Construction

- Home Energy Management System

- Residential Multi-Family EE Program

- Residential Manufactured Housing Program

- Residential EE Kits

- Residential Energy Advisor Program

- Residential Electric Vehicle Program

- Residential Enhanced Behavioral Program

- Non-Residential Behavioral Program

- Non-Residential Targeted-Sector Program

- Non-Residential Upstream and Midstream Efficient Products Incentives

- Non-Residential New Construction

- Non-Residential Strategic Energy Management

- Agricultural Energy Efficiency

We will continue to keep our members apprised of how these programs shape up for the next DSM filing in October 2019.

In October 2018, Dominion Energy proposed eleven new Demand-Response (DR) programs, ten of which are for energy efficiency, as part of their ten-year commitment to energy efficiency programs under the Grid Transformation and Security Act of 2018 (GTSA). The application totals $225.8 million of the $870 million committed under the GTSA, and includes six residential programs and five non-residential programs:

In October 2018, Dominion Energy proposed eleven new Demand-Response (DR) programs, ten of which are for energy efficiency, as part of their ten-year commitment to energy efficiency programs under the Grid Transformation and Security Act of 2018 (GTSA). The application totals $225.8 million of the $870 million committed under the GTSA, and includes six residential programs and five non-residential programs:

- Residential

- Appliance Recycling Program: would incentivize consumers to recycle eligible freezers and refrigerators.

- Home Energy Assessment Program: would facilitate a walk-through energy assessment and incentivize efficiency upgrades based on the findings.

- Smart Thermostat Management Program (DR): would provide consumers who already have an eligible smart thermostat an annual incentive to enroll in a peak demand response program.

- Smart Thermostat Management Program (EE): would provide a one-time rebate for customers who purchase an eligible smart thermostat.

- Efficient Products Marketplace Program: would establish a rebate program for qualified efficient products purchased through participating retailers or an online marketplace.

- Customer Engagement Program: would provide consumers with energy use data and energy saving suggestions.

- Non-residential

- Heating and Cooling Efficiency Program: would provide an incentive to qualifying customers to implement high efficiency heating and cooling technologies.

- Lighting Systems & Controls Program: would provide an incentive to qualifying customers to implement efficient lighting technologies with verifiable savings.

- Window Film Program: would incentivize customers to install solar reduction window film.

- Office Program: would offer incentives for installation of a variety of energy efficiency measures related to building systems to small office facilities.

- Small Manufacturing Program: would offer incentives for installation of a variety of energy efficiency measures to small manufacturing companies, primarily regarding compressed air systems.

If you are a VAEEC member, be sure to sign up for our webinar on March 5th for a deeper dive into the filing and a tutorial on how to prepare your own comments on these programs.

VAEEC has once again formally intervened in support of these programs in the proceeding before the State Corporation Commission (PUR-2018-00168) with Rachel Gold from the American Council for an Energy-Efficiency Economy (ACEEE) acting as our expert witness. We have again retained counsel from the UVA Environmental and Regulatory Law Clinic in support of the Company’s application.

In our pre-filed testimony, we provided strategies to improve the overall portfolio, provided analysis of the Company’s spending on EE programs as compared to other utilities in their peer group, and their progress towards spending $870M.

As part of our testimony, ACEEE performed a gap analysis to determine what other programs should be included in future DSM filings to reach $870M. This gap analysis identified five major program areas for future inclusion: Multi-Family, New Construction, Commercial & Industrial, Strategic Energy Management, and Midstream programs. These suggestions are listed in more detail on page 19 of our pre-filed testimony.

Our testimony includes additional analysis of Dominion’s spending on EE programs as compared to other utilities in their peer group, which is a group defined by the SCC. This group consists of six other southeastern utilities, including Duke Energy, APCo, and South Carolina Electric and Gas. According to that analysis, only the last two utilities listed spent less than Dominion on energy efficiency programs as a percentage of revenues in 2017, indicating that there is ample room for program expansion and a strong feasibility in meeting the $870M commitment.

Additionally, we do not support the Company’s inclusion of lost revenues in the $225M spending cap for energy efficiency programs since they are not costs associated with these specific programs. As stated in Ms. Gold’s testimony, “Lost revenue is not a cost of energy efficiency for the simple reason that these revenues still exist and are recovered by the utility from customers, even without any efficiency programs at all.” Including lost company revenues in the spending cap greatly reduces the amount of spending on actual energy-saving programs that benefit both the consumer and the companies that provide those services.

Finally, our pre-filed testimony also provided suggestions to maximize the effectiveness of the stakeholder process that was established under the GTSA last year. Building on the Stakeholder Framework VAEEC created last year in partnership with other groups like ACEEE, our testimony recommends setting clear objectives for the stakeholder group, focusing on three main areas: program design, evaluation, and policy. We also make recommendations based on the successful passage of SB 1605 and HB 2293, which will clarify the duration of the stakeholder process in addition to providing accountability measures for the group itself.

While our testimony has been filed, there is still ample time for non-intervenors to participate. The timeline below highlights some key dates, including due dates for written and oral public comments. We hope you will sign up for our webinar on March 5th to learn how to prepare your own comments for submission.

Timeline

February 15th: SCC Staff report due

March 5th: VAEEC members-only webinar, featuring Rachel Gold from ACEEE

March 13th: Written public comments due

March 20th: Proceeding before the SCC Commissioners, including public testimony

Late May/ Early June: SCC Final Order

Sign up today for our March 5th webinar!

If you are interested in researching further into this filing, you can use the search feature on the SCC website to read through public documents in the proceeding. Make sure to use the case number, PUR-2018-00168.

Since the end of the General Assembly session back in March 2018, there have been quite a few updates on utility energy efficiency programs. Some of you may have attended our spring breakout session on utility programs.

Since the end of the General Assembly session back in March 2018, there have been quite a few updates on utility energy efficiency programs. Some of you may have attended our spring breakout session on utility programs.

VAEEC members can get a deeper dive into these updates by visiting our Member Resources page. From there, you can read all of our blog posts during the session, in case you missed them the first time and can scan a newly-updated presentation we created just for members.

If you have trouble accessing the Member Resources page, please contact our Program Coordinator, Jessica Greene Jessica@vaeec.org.

If you are not a member but would like to receive this same, in-depth information, we hope you will consider joining today.

Passage of the Grid Transformation and Security Act of 2018 underscores the widespread, bipartisan agreement that energy efficiency is a smart investment for the Commonwealth. The VAEEC endorsed this legislation because of the tremendous potential opportunities for energy-saving programs that will be provided to Virginians over the next decade, including a combined commitment by the electric utilities to spend over $1.3 billion on energy efficiency programs. Unfortunately, all of that potential could easily evaporate away.

Last month, the State Corporation Commission (SCC) held proceedings to review proposed energy efficiency programs for both Appalachian Power Company (APCO) and Dominion Energy. Dominion Energy filed for approval to extend their low-income program for another five years. As defined by Virginia law, low-income programs are already determined to be in the public interest so these types of programs do not face as much scrutiny by the SCC.

During the APCO proceeding however, the SCC staff recommended rejecting all five of the utility’s proposed residential programs. For three of these programs, the SCC staff stated that the utility had not taken into account new federal lighting standards taking effect in 2020. APCO decided to withdraw one of the programs for consideration due to this change but argued in their rebuttal testimony that the SCC staff’s interpretation of the new standard was incorrect for the other two programs since they would be direct install measures. Meaning, the program contractors would directly install the new LED light bulbs into sockets where incandescent light bulbs currently exist and would not be replacing CFL light bulbs with LEDs, as stated in the SCC staff response.

During the APCO proceeding however, the SCC staff recommended rejecting all five of the utility’s proposed residential programs. For three of these programs, the SCC staff stated that the utility had not taken into account new federal lighting standards taking effect in 2020. APCO decided to withdraw one of the programs for consideration due to this change but argued in their rebuttal testimony that the SCC staff’s interpretation of the new standard was incorrect for the other two programs since they would be direct install measures. Meaning, the program contractors would directly install the new LED light bulbs into sockets where incandescent light bulbs currently exist and would not be replacing CFL light bulbs with LEDs, as stated in the SCC staff response.

Similarly concerning was the SCC staff’s re-calculation of the cost-benefit tests for APCO’s appliance recycling program renewal, which incentivizes customers in their territory to recycle secondary appliances such as refrigerators. The SCC staff stated that the company miscalculated the cost-benefit tests of this program and performed new calculations, causing the program to fail two of the four cost-benefit tests.

According to experts I’ve spoken with, these new test results calculated by the SCC staff for the appliance recycling program are questionable since there is no customer cost for this particular program, therefore, it is unclear how this program could fail the Total Resource Cost Test but not the Utility Cost Test. Below is a table that was produced in a 2014 VAEEC report explaining the purpose of all four tests.

You may be wondering what this means, especially since this is all pretty technical, but what it boils down to is this: the substantial commitments to energy efficiency by both Dominion Energy and Appalachian Power Company in the omnibus utility bill will not come to fruition if energy efficiency programs continue to be scrutinized in this manner.

To be clear, the VAEEC supports the role that the SCC plays in scrutinizing proposals put forth by the utilities. That is their job and it is an important one. However, they tend to scrutinize energy efficiency programs more so than other proposals- including new power generating facilities. They do not view energy efficiency as a true resource when it comes to planning for future energy needs, when, in fact, it should be viewed as the critical first step. The kilowatt that goes unused is the cheapest form of energy. Allowing utilities to develop robust programs that help all customers make smart energy choices helps reduce the need for new, larger power generation facilities in the future. Energy efficiency isn’t a silver bullet by any means, but it is a valuable tool in the toolbox that should be utilized much more often than it is now.

Investments in energy efficiency also mean new jobs in every corner of Virginia. In our report “Why Energy Efficiency is a Smart investment for Virginia,” we found that energy efficiency is a $1.5 billion industry in Virginia that supports approximately 75,000 jobs. Greater investments and growth in energy efficiency means more jobs in the local communities being served- jobs that cannot be outsourced out-of-state or overseas. This is the argument that we have made before the SCC over the last two years.

The SCC should evaluate the economic development and job creating benefits that these programs create in the local communities they serve. These same benefits are included in the analysis to build new fossil-fueled facilities, so why wouldn’t the same economic benefits for energy efficiency be factored in as well? Especially given that most of the jobs created by building new power plants are temporary construction jobs whereas the jobs provided by energy efficiency programs are year-round and last for the life cycle of program.

The vacant seat on the SCC provides a unique opportunity to unleash the economic potential of energy efficiency for the citizens of the Commonwealth. It is our hope that a new Commissioner is appointed soon and that he or she sees the value and tremendous opportunity that energy efficiency provides. Otherwise, we will be leaving over a billion dollars on the table.

The

The  In October 2018, Dominion Energy proposed eleven new Demand-Response (DR) programs, ten of which are for energy efficiency, as part of their ten-year commitment to energy efficiency programs under the

In October 2018, Dominion Energy proposed eleven new Demand-Response (DR) programs, ten of which are for energy efficiency, as part of their ten-year commitment to energy efficiency programs under the  Since the end of the General Assembly session back in March 2018, there have been quite a few updates on utility energy efficiency programs. Some of you may have attended our spring breakout session on

Since the end of the General Assembly session back in March 2018, there have been quite a few updates on utility energy efficiency programs. Some of you may have attended our spring breakout session on  During the APCO proceeding however,

During the APCO proceeding however,