The Case for C-PACE in the Lending Community

C-PACE finances EE improves for commercial and multifamily buildings

By now, many people in this industry have at least heard of Commercial Property Assessed Clean Energy, or C-PACE. Across the Mid-Atlantic region, VAEEC and other stakeholders, including the Mid-Atlantic PACE Alliance, or MAPA, have been working diligently to accelerate the implementation of C-PACE programs and projects. Through this work, over $50 million of C-PACE projects have been financed across the region since January 2017.

C-PACE is a voluntary special assessment that is added to a property’s real estate tax bill. It provides building owners with a means to finance energy efficiency, water conservation, renewable energy, stormwater management, and resiliency projects for new and existing commercial, industrial, multifamily (with five+ dwellings), and nonprofit properties.

C-PACE is more advantageous than traditional financing by providing 100% financing, no upfront cash investment, and immediate savings. In fact, many projects are cash-flow positive from day one.

Benefits of C-PACE

- Increased building value

- Reduced utility bills

- More comfortable space with improved air quality

- 100% financing: no upfront cash investment required

- Long-term loans up to 25+ years: lower annual payments, positive cash flow

- Repaid as a Special Assessment on the Real Estate Tax Bill

- Transferable: the loan stays with the property upon sale

- Non-accelerating

- Can fill a gap in the capital stack

- Contributes to economic development, local job creations, and improved public health

How C-PACE differs from traditional financing options

| Traditional Construction Loan | C-PACE Assessment | |

|---|---|---|

| Purpose | HVAC and Lighting | HVAC and Lighting |

| Project Cost | $100,000 | $100,000 |

| Loan | $75,000 25% upfront cash investment required | $100,000 0% upfront investment required |

| Interest Rate | 5% | 6.25% |

| Term | 5 years, fully amortizing | 15 years, fully amortizing |

| Monthly Payment | $1,415 | $857 |

| Annual Payment | $16,984 | $10,290 |

What role does the lending community play?

Funding for C-PACE projects comes from private capital providers, including local, regional, and national banks and investors. Capital providers or lenders approve the financing eligibility and underwriting for the project. They even have the ability to act as the project originator and can assist the owner with obtaining mortgage holder consent.

How does C-PACE benefit the lending community?

- This fairly new financing mechanism provides lenders and capital providers with new funding opportunities.

- C-PACE provides a good fixed rate of return without the property owner needing to refinance or incur additional transaction costs.

- The ability to transfer the C-PACE assessment to a new owner upon sale provides the current owner with an incentive to make building improvements now.

How are mortgage lenders involved?

Since C-PACE is secured by a special assessment, a corresponding lien is placed on the property. This is similar to how localities fund public infrastructure projects, such as sewers. The assessment is senior to all commercial liens, including mortgages. Therefore, property owners must obtain consent from their mortgage lender before the project can be approved.

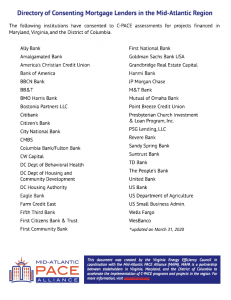

To date, over 200 mortgage lenders across the nation have consented to C-PACE assessments for a variety of reasons. In partnership with MAPA, VAEEC has put together a directory of mortgage lenders who have consented to C-PACE in the Mid-Atlantic region. If you are looking to utilize C-PACE financing, you can check this directory to see if your mortgage lender is on the list.

Don’t see your mortgage lender listed? MAPA has put together a guide highlighting the top six reasons a mortgage lender would consent to a C-PACE assessment. The Case for Lender Consent: A C-PACE guide for mortgage lenders & property owners is an excellent way to engage your property’s senior lender(s) to assess their receptiveness to C-PACE early on in the project.

Stay tuned to learn more! MAPA will be holding a webinar, Financing C-PACE with Regional and Local Lending Partners, in the near future.