Developed on behalf of the Energy Efficiency For All Project, the Vermont Energy Investment Corporation just released a report, Commercial PACE for Affordable Multifamily Housing, looking into the handful of affordable multifamily transactions that have used Commercial Property Assessed Clean Energy financing, or C-PACE.

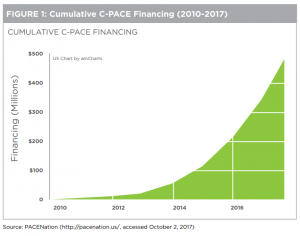

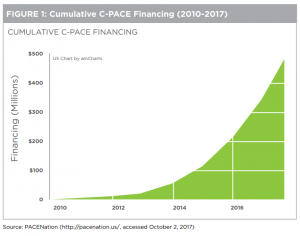

Growth of C-PACE in the US since 2010

In the past seven years, C-PACE financing has grown exponentially across the U.S. In fact, the latest numbers from PACENation show that there has been $521 million in C-PACE assessments funded through 1,157 projects. However, very few affordable multifamily housing stakeholders have taken advantage of this financing mechanism. Therefore, the purpose of this report was to explore whether or not C-PACE can be used to fill a financing gap for energy efficiency in the affordable multifamily buildings sector, and if so, to identify the best practices.

Several theories exist as to why C-PACE has not been commonly used in the affordable multifamily sector. However, the case for using C-PACE in affordable multifamily housing is strong:

- Tax assessment, not a loan

- Off balance sheet

- Based on owner’s equity rather than future income

- Structured to recoup savings to cover costs

- Potential to fill financing gaps

Through cataloging existing C-PACE programs that have either been used by or created for the affordable multifamily sector, the study revealed the following findings:

- There have been few C-PACE transactions within the affordable multifamily housing sector.

- Most of the completed transactions have had relatively simple financing structures.

- Thus far, only one C-PACE deal has been used on a U.S. Department of Housing and Urban Development (HUD) financed property, and only one deal used on an affordable, multifamily transaction using the Low-Income Housing Tax Credit (LIHTC).

- The differences in each state’s enabling legislation have not led to substantive differences for C-PACE program administrators. However, these variations at the local and state level could hinder the ability of capital across state borders.

- There could be difficulties using C-PACE on new construction due to the difficulty of determining the Savings to Investment Ratio (SIR).

Based on these findings, the authors were able to compile best practices and recommendations for using C-PACE with affordable multifamily properties:

For Policymakers and Program Administrators-

- Encourage open PACE program design

- Identify and pursue opportunities with the fewest barriers

- Encourage opportunities in public housing

- Increase and document communication with HUD

- Require cost-effective investments

- Consider local development corporations (LDCs)

- Consider extended financing terms rather than rate buy downs

- Consider potential in USDA properties

For Affordable Housing Stakeholders Implementing C-PACE-

- Consider C-PACE as gap financing

- Prioritize C-PACE for recapitalization, not for mid-cycle retrofits

- Encourage state housing finance agencies involvement

- Continue to document and codify the use of C-PACE in multifamily affordable housing

Energy efficiency improvements in affordable multifamily housing reduces energy burdens for residents and helps preserve this important housing stock. The Commercial PACE for Affordable Multifamily Housing study shows that there are instances where C-PACE could help unlock additional energy savings in multifamily properties. Benefits of C-PACE should not just be enjoyed by the commercial and industrial sectors; there is a lot of potential for C-PACE to benefit the multifamily sector.

Click here to read the entire report.

VAEEC’s C-PACE Efforts

The VAEEC is committed to accelerating the implementation and utilization of C-PACE throughout the Commonwealth. Along with our PACE technical consultant, Abacus Property Solutions, the VAEEC has been intimately involved in C-PACE education and outreach with stakeholders, including localities, property owners and developers, contractors, and lenders, to build a coalition of supporters and to encourage localities to move forward with developing C-PACE programs. Additionally, we have been working with stakeholders to develop a model ordinance and with our Mid-Atlantic PACE Alliance, or MAPA, partners to develop regional guidelines to accelerate the implementation of successful C-PACE programs throughout the Commonwealth and Mid-Atlantic region.

This study found that the high cost of C-PACE financing compared to the low cost of capital through federal or state backed housing loans is a barrier. However, in speaking with the Virginia Housing and Development Authority (VHDA) and other LIHTC experts in the Commonwealth, these low cost loans have specific restrictions that limit the ability to go beyond the standard needs of a building. In this instance, C-PACE can provide financing for measures that cannot be underwritten by HUD or VHDA, such as solar photovoltaics.

Additionally, the study briefly mentions the interaction of C-PACE on new construction and the challenges it can entail. The VAEEC has begun reaching out and working with stakeholders across the country who have experience using C-PACE with new construction to compile a list of best practices and lessons learned. This includes a list of projects that should qualify for C-PACE financing, how to determine the Savings to Investment ratio (SIR), and how to determine what percentage of the construction costs are eligible for C-PACE financing. We will continue this outreach in an effort to provide guidance to stakeholders hoping to use C-PACE on new construction in Virginia and the Mid-Atlantic region.

The VAEEC agrees with the study’s findings about the potential of C-PACE within the multifamily sector. In fact, this is a sector that we intend to focus on more in 2018. We will be working with our members, partners, and stakeholders to increase the awareness and knowledge of C-PACE within the multifamily sector.

To learn more about the basics of C-PACE, view the VAEEC PACE webpage, factsheet, or PACE video.

On November 29, 2017, the Virginia Energy Efficiency Council held our latest Commercial Property Assessed Clean Energy, or PACE, Lunch + Learn for Fairfax County and surrounding areas. With an audience of approximately 70 contractors, developers, property owners, lenders, and government officials, this was our largest PACE Lunch + Learn event to-date. The Great Falls Group of the Virginia Sierra Club co-hosted the event, and sponsors included Petros PACE Finance (event sponsor) and John Marshall Bank- Tysons Corner Region (lunch and networking sponsor).

The following speakers provided attendees with an overview of Commercial PACE, including its status across the Commonwealth, case studies, and its value proposition for the area, as well as the development and status of Arlington County’s PACE program:

The following speakers provided attendees with an overview of Commercial PACE, including its status across the Commonwealth, case studies, and its value proposition for the area, as well as the development and status of Arlington County’s PACE program:

- Abigail Johnson, President, Abacus Property Solutions and Atlantic PACE

- Cliff Kellogg, Vice President of Strategic Initiatives, Petros PACE Finance

- Richard Dooley, Community Energy Coordinator, Arlington County

The timing of this event allowed speakers to update guests on the recent PACE advances in the Commonwealth:

On November 18th, the Arlington County Board approved the County’s PACE ordinance, thus making Arlington the first locality in Virginia to offer a PACE program. Sustainable Real Estate Solutions, or SRS, will serve as the County’s program administrator in charge of outreach and education, project underwriting, and quality assurance. The program is expected to launch this month, and the County is holding a PACE training for contractors on December 12th.

On November 18th, the Arlington County Board approved the County’s PACE ordinance, thus making Arlington the first locality in Virginia to offer a PACE program. Sustainable Real Estate Solutions, or SRS, will serve as the County’s program administrator in charge of outreach and education, project underwriting, and quality assurance. The program is expected to launch this month, and the County is holding a PACE training for contractors on December 12th.

In October, Loudoun County’s Finance Committee forwarded a resolution to adopt a PACE program to the full Board for discussion. The Board will be reviewing this resolution at their January 18th meeting.

- Virginia Model Ordinance and Regional Guidelines will become available in January 2018.

The VAEEC is working with our partners to create a PACE model ordinance, which will help jurisdictions looking to develop their own PACE program. The ordinance will define the roles of all key parties (program administrator, jurisdiction, property owner, and lender), list qualifying improvements, specify how PACE works, and provide a cooperative procurement rider.

As a part of the Mid-Atlantic PACE Alliance, or MAPA, the VAEEC is working with partners across Virginia, Maryland, and DC to develop regional PACE program guidelines. These guidelines will include: project eligibility standards; the process for a typical PACE project; a suite of template documents; and application requirements. The guidelines will help provide consistency of design, administration, and documents within the Mid-Atlantic region while encouraging standardization and transparency.

As a part of the Mid-Atlantic PACE Alliance, or MAPA, the VAEEC is working with partners across Virginia, Maryland, and DC to develop regional PACE program guidelines. These guidelines will include: project eligibility standards; the process for a typical PACE project; a suite of template documents; and application requirements. The guidelines will help provide consistency of design, administration, and documents within the Mid-Atlantic region while encouraging standardization and transparency.

The Fairfax County Lunch + Learn Presentation and C-PACE Resources document are available to view and download. Visit the VAEEC’s PACE webpage or contact Jessica Greene (jessica@vaeec.org) to learn more about PACE and its status in Virginia.

By now, many of you have probably heard us speak about commercial Property Assessed Clean Energy, or PACE, financing. It has become one of VAEEC’s top focuses in the past few years due to its ability to spur economic growth and revitalization while also reducing energy usage in commercial buildings. To learn more about the basics of PACE, visit our PACE webpage.

By now, many of you have probably heard us speak about commercial Property Assessed Clean Energy, or PACE, financing. It has become one of VAEEC’s top focuses in the past few years due to its ability to spur economic growth and revitalization while also reducing energy usage in commercial buildings. To learn more about the basics of PACE, visit our PACE webpage.

Recently, VAEEC held our second PACE webinar, C-PACE Financing in Virginia, back in September. Unlike our first PACE webinar, which mainly covered the basics of PACE, the main goal of this webinar was to be a resource for localities interested in developing and implementing a PACE program. The webinar provided listeners with:

- A brief overview of C-PACE, including its legality and case studies,

- Best practices when developing and implementing a program,

- The program administrator’s role,

- The benefits to localities, and

- The internal process of developing a PACE program.

PACE provides financing for energy efficiency renovations for commercial and multifamily buildings.

William Nusbaum (Williams Mullen) kicked things off with an overview of what PACE is and how it works in Virginia. He also touched on the Mid-Atlantic PACE Alliance, or MAPA, which is a partnership between Virginia, Maryland, and DC stakeholders created to accelerate PACE programs and project closings in the region.

Time and resources are by far the two most common concerns we hear from localities when talking about developing a PACE program. Scott Dicke (Sustainable Real Estate Solutions (SRS) and Arlington C-PACE) was able to address these concerns by discussing the role of the PACE program administrator. Program administrators alleviate the burdens placed on a locality when starting up and running a PACE program. They provide contractor education and support services to contractors, building owners, capital providers, and localities. Scott reinforced these points by providing case studies of programs SRS has helped launch and run.

Susan Elliott (City of Charlottesville) closed out the webinar with a local government perspective. Localities are interested in PACE because it is a tool that helps spur economic develop and revitalize existing building stock. Furthermore, Susan dove into the internal process of developing a PACE program and spoke about existing resources that help localities each step of the way.

Presentation slides and the audio recording can be accessed here. If you have any questions or if you would like additional information about PACE, please contact Jessica Greene.

A special thank you to Williams Mullen, our webinar sponsor, and our speakers.

Property Assessed Clean Energy financing, or PACE, is starting to get more and more attention around the Commonwealth and the nation. In fact, Governor McAuliffe and his administration recognized PACE as a viable means to create more jobs, save energy, and lower electricity bills in a recent press release. As it’s popularity increases, many are still unaware of just exactly what PACE is and who it can benefit.

Property Assessed Clean Energy financing, or PACE, is starting to get more and more attention around the Commonwealth and the nation. In fact, Governor McAuliffe and his administration recognized PACE as a viable means to create more jobs, save energy, and lower electricity bills in a recent press release. As it’s popularity increases, many are still unaware of just exactly what PACE is and who it can benefit.

PACE financing is a loan program to help bring low-cost, long-term capital to fund the rehabilitation of existing and new privately owned commercial buildings through energy efficiency, renewable energy, and water conservation projects. The loan is repaid annually through the property’s real estate tax bill.

Thirty-three states and Washington, D.C. have passed legislation at the state level to enable PACE financing; nineteen of those states have already started a PACE program. In Virginia, a commercial PACE, or C-PACE, enabling law was originally enacted in 2009 and amended in 2015. Virginia’s PACE law requires a locality to develop a PACE program, and private lenders make the loan and negotiate directly with the property owner on rates and terms. Currently, Arlington County is the only Virginia jurisdiction actively developing a PACE program; however, several over localities are exploring the development of their own programs.

Practically all privately-owned commercial buildings, regardless of size, are eligible for PACE financing, including office, retail, hotel, and industrial space. Eligible PACE projects must either reduce energy consumption or generate energy, and they must be permanently affixed to the property. Eligible improvements include: insulation, solar panels, lighting, roofing, and HVAC systems. In Virginia, commercial, nonprofit, and multifamily buildings (except condos and dwellings with less than five units) are eligible regardless of their age.

PACE offers an array of benefits for each key stakeholder: property owner, contractor, lender, locality.

Property owners:

– 100% financing: PACE covers 100% of all hard and soft project costs, eliminating the need for upfront cash investment.

– Long-term loan: With terms up to 20+ years, PACE loans result in lower annual payments and immediate positive cash flow.

– Transferable: PACE loans do not have to be paid off at the time of sale; they transfer to the new owner.

– Non-accelerating loan

Contractors:

– Increase sales volume and improve profit margin: By covering 100% of project costs and eliminating the requirement for out-of-pocket expense, PACE brings financing to more customers. Since PACE is based on equity in the property and not personal credit, it is easier for more customers to obtain financing.

– Fund deeper energy retrofits: Long-term financing enables customers to take advantage of projects with longer paybacks, which leads to more comprehensive projects with greater effect on energy usage. PACE can also fund efficiency improvements that are not allowable uses of Weatherization Assistance Program funds (i.e. replacement windows).

– Gain support and resources: PACE programs can be developed to offer an array of contractor services to help grow business and streamline financing. Services include training, call center support, customizable marketing materials, tools to pre-qualify customers, project estimation calculators, and web portals for financial analysis and deal-tracking.

– Spur demand for retrofits and energy auditors: As the number of people taking advantage of PACE increases, PACE could spur a surge of private demand for well-trained retrofitters. Additionally, as the program grows, so will the demand for energy audits. Energy audits are used to track a building’s energy usage before and after PACE improvements are installed.

Lenders:

– Meet client’s needs of implementing upgrades

– Increase value of collateral: upgrades and improvements increases the value of the property

– Enhances property owner’s ability to pay their debt: raises net operating income (NOI) through low annual payments and decreased operating costs

Localities:

– Creates employment opportunities for contractors, trades, engineers, vendors, etc.

– Serves as a redevelopment tool for “tired” buildings with obsolescent and inefficient systems

– Improvements make buildings more marketable, leading to better tenant retention and increases property values

– Increased property taxes and construction fees yields more revenues for jurisdictions

– Reduces locality’s carbon footprint, enabling it to become a green leader

– Minimal municipal burden: a third party administrator carries the cost of starting and running the program

The difference between traditional bank financing and PACE financing:

| Traditional Bank Financing |

PACE Financing |

| Purpose: HVAC and Lighting |

Purpose: HVAC and Lighting |

| Project Cost: $100,000 |

Project Cost: $100,000 |

| Loan: $75,000

25% upfront cash investment required |

Loan: $100,000

$0 upfront cash investment required |

| Interest Rate: 5% |

Interest Rate: 6.25% |

| Term: 5 years, fully amortizing |

Term: 15 years, fully amortizing |

| Monthly Payment: $1,415 |

Monthly Payment: $857 |

| Annual Payment: $16,984 |

Annual Payment: $10,290 |

PACE financing is a lucrative tool that can benefit all parties involved. We look forward to seeing Arlington get their program up and running later this year and are excited to continue working with other localities as they explore the feasibility of developing their own PACE programs.

If you would like additional information about PACE, please contact VAEEC Program Coordinator Jessica Greene.

Last week (February 20, 2017) VAEEC participated in the first Mid-Atlantic PACE Alliance (MAPA) kick-off meeting in northern Virginia. MAPA is the result of a U.S. Department of Energy grant to support the development, implementation, and utilization of Commercial Property Assessed Clean Energy (C-PACE) programs throughout Virginia, Maryland, and Washington, D.C. The Virginia Department of Mines, Minerals and Energy is leading this effort between private and public stakeholders to develop and promote best practices, which will make the development of PACE programs more effective and will accelerate the growth of C-PACE programs throughout the region.

Last week (February 20, 2017) VAEEC participated in the first Mid-Atlantic PACE Alliance (MAPA) kick-off meeting in northern Virginia. MAPA is the result of a U.S. Department of Energy grant to support the development, implementation, and utilization of Commercial Property Assessed Clean Energy (C-PACE) programs throughout Virginia, Maryland, and Washington, D.C. The Virginia Department of Mines, Minerals and Energy is leading this effort between private and public stakeholders to develop and promote best practices, which will make the development of PACE programs more effective and will accelerate the growth of C-PACE programs throughout the region.

Educating stakeholders and standardizing templates and models are two key focuses of the MAPA team. Partners will use grant money to educate primary stakeholders (localities, property owners, lenders and borrowers, and contractors) about PACE. The second focus is to develop streamlined, consistent practices that will propel the adoption of PACE across Virginia while supporting the expansion of existing programs in Maryland and Washington, D.C. This includes the creation of consistent, cost-effective practices for program administration, drafting ordinances, financial underwriting guidelines, measurement and verification requirements, contractor training, and overall support.

This grant will enhance the work the VAEEC is already doing to further promote and advance PACE throughout the Commonwealth.

Click here to learn more about MAPA and here to read a copy of Governor McAuliffe’s press release about the grant.

The Virginia Energy Efficiency Council is diligently working to build a coalition of support for Property Assessed Clean Energy financing, or PACE, and to provide guidance and resources to localities interested in developing PACE programs. To assist with this effort, VAEEC has initiated a series of events across the Commonwealth suitably called “PACE Lunch + Learns”. Each event is open to anyone interested in learning more about PACE; however, these events target commercial property owners, contractors, lenders, and local government officials. Knowledgeable speakers from the field will provide attendees with information on PACE and answer PACE-related questions. VAEEC is teaming up with different sponsors to host the events and provide a complimentary lunch to all in attendance.

On Monday, December 5, VAEEC and Williams Mullen kicked off the first Lunch + Learn for the Hampton Roads/Norfolk area with a diverse group of nearly 30 people in attendance. Speakers included Abby Johnson, Bill Nusbaum, and Rich Dooley. Abby Johnson is the President and founder of Abacus Property Solutions, an independent real estate advisory firm. Abacus provides PACE project development and consulting and works with capital partners to identify PACE opportunities and develop PACE programs. Bill Nusbaum is an attorney with Williams Mullen, a full-service law firm, which is a key stakeholder in developing PACE financial underwriting guidelines with the Department of Mines, Minerals and Energy along with Abacus and VAEEC. Rich Dooley is the Community Energy Coordinator with Arlington Initiative to Rethink Energy (AIRE) in Arlington County. AIRE’s goal is to cut greenhouse gas emissions from County operations. Arlington County is the first locality in the Commonwealth on track to develop a PACE program.

The presentation provided a wealth of knowledge for all in attendance as it covered many different aspects of PACE. Here are my key take-aways:

- PACE provides a win-win opportunity for property owners, contractors, localities, and lenders. Through PACE financing, commercial and multifamily property owners can receive 100% project funding for energy efficiency, renewable energy, and water conservation upgrades. The loan is paid back as a line item on the property tax bill, and in most cases, the utility savings from the funded projects cover the costs of the loan. Additionally, as a senior lien status, PACE assessments stay with the property upon sale.

- Contractors benefit from PACE through increased sales volume and improved profit margin. By helping customers reduce costs and improve the value of their property, customers are able to spend more on additional building improvements.

- PACE spurs economic development within localities. Not only does PACE provides jobs, it improves building stock and increases property values, which produces more revenue for the jurisdiction. PACE serves as a redevelopment tool for older buildings at little to no cost to the locality; third party providers carry the cost of starting and maintaining the program. Furthermore, PACE helps decrease a locality’s carbon footprint.

- Based on the types of questions posed by the audience, the advantages of PACE to lenders is perhaps the hardest to grasp. In order for a PACE program to be full-fledged and offer the most benefits to all parties involved, the existing mortgage holder must consent to allow PACE to take senior lien status. However, PACE is still beneficial to lenders because it increases the value of their collateral. Moreover, PACE improves a property’s net operating income (through reduced utility bills), and the project is cash flow positive (the loan payment is typically less than the energy savings). In fact, over 200 lenders nationwide have already consented to make their mortgage junior lien status because they recognize these benefits.

- Arlington County is on track to become the first locality within the state to develop a PACE program. Other localities, such as Norfolk, the City of Fairfax, and Richmond have expressed interest in developing PACE programs.

- To facilitate interest in and garner support for PACE, Arlington engaged with the real estate community and coordinated with the private sector and several County departments. By building a relationship with these groups, there was enough interest in PACE to begin developing a program. Currently, Arlington is in the midst of finalizing a Program Administrator. The program is on track to launch in early 2017.

Our next PACE Lunch + Learn is scheduled for Tuesday, January 31 in Ashland. Stay tuned for a Lunch + Learn event in your area.

Last week (September 26, 2016) I started my new position of Program Coordinator with Virginia Energy Efficiency Council, where a large portion of my job is dedicated to building coalitions of PACE (Property Assessed Clean Energy financing) supporters throughout the Commonwealth. Being relatively new to the world of PACE, I immediately immersed myself in PACE research. Therefore, imagine my excitement when I learned VAEEC was kicking off their webinar series with a “PACE in Virginia” webinar!

The webinar promised an overview of PACE financing, including benefits to contractors and property owners, case studies, and a breakdown of what PACE looks like in Virginia, presented by three speakers with amply knowledge and experience in the field. And it delivered.

I found the webinar to be incredibly beneficial. Elyssa Rothe’s (PACENation) overview reinforced the basics of PACE, which provided good background knowledge for the rest of the presentation. Abigail Johnson (Abacus Property Solutions) dove further into the benefits of PACE and provided two case studies as examples. Bill Greenleaf (Virginia Community Capital) ended the webinar with a summary of what PACE looks like in Virginia.

Here are my greatest take-aways from the webinar:

- PACE is for energy efficiency and renewables and many different building types. can be used for projects that either reduce or generate energy, including energy efficiency upgrades and renewable energy. Furthermore, it is available for all kinds of commercial building types; multi-family, hotel, office, retail, agriculture, and industrial. Government owned buildings are the only exception.

- PACE offers several advantages over traditional bank financing. It covers 100% of a project’s costs, while offering a competitive interest rate. Instead of the typical 5-7 year terms, PACE can be financed for up to 20 years, which lowers annual payments. Financing is repaid annually via the building’s property tax assessment. Additionally, assessments stay with the property and automatically transfer to a new owner.

- In Virginia, local governments must past ordinances to establish PACE programs or contract to a third party. Commercial PACE, or C-PACE, was enhanced in 2015 and applies to commercial buildings with at least 5 units.

If you were unable to attend the webinar, I urge you watch our “PACE in Virginia” webinar recording. Even if you already have a good understanding of PACE, this webinar will serve as a great refresher as you listen to experts well entrenched in the field.

Please note that we also have a PACE page on our website with updates and resources.

Since our last post about PACE (Property Assessed Clean Energy) in Virginia, we continue to move the needle forward on PACE financing in our state. In early April, Virginia Community Capital released the final recommendations from our Oak Hill Fund grant.

Since our last post about PACE (Property Assessed Clean Energy) in Virginia, we continue to move the needle forward on PACE financing in our state. In early April, Virginia Community Capital released the final recommendations from our Oak Hill Fund grant.

Although we concluded that a statewide program administrator would be the ideal solution to ensure rapid advancement of PACE in Virginia, we also concluded that there is no known existing funding to support the creation of statewide program administrator. However, Abacus Property Solutions assisted the Virginia Department of Mines, Minerals and Energy (DMME) in responding to a Department of Energy State Energy Program (SEP) grant that, if awarded, would provide Virginia and partner states, Maryland and District of Columbia, with $500,000 in PACE funding across our region. This three-year grant would help seed and develop statewide PACE efforts including:

- Develop standardized, and low-cost program design and administrative structures throughout the region;

- Increase market awareness of PACE through coordinated outreach to and education of key stakeholder groups whose participation in PACE will accelerate its adoption and growth in the region.

If awarded, the DOE grant would address specifically administrative structure, owner eligibility, financial underwriting guidelines, energy audit and measurement & verification requirements, contractor training and support, capital provider support, and marketing messages and strategy. The VAEEC would receive a portion of this funding from this DOE/DMME grant to implement some of the work in the grant.

If awarded, the DOE grant would address specifically administrative structure, owner eligibility, financial underwriting guidelines, energy audit and measurement & verification requirements, contractor training and support, capital provider support, and marketing messages and strategy. The VAEEC would receive a portion of this funding from this DOE/DMME grant to implement some of the work in the grant.

We feel that our response was strong due to our regional approach across three states and the problem that we are solving with a standardized model. DMME should know by late August or early September 2016 if we were awarded the grant, with funding provided by mid fall.

In the interim, the grant recommendations included the notion that VAEEC develop a comprehensive local government and energy contractor PACE education and outreach effort and offer technical assistance to local governments interested in PACE. An additional recommended task is to build grassroots efforts to compel localities to create PACE programs. The VAEEC is well positioned to build a grassroots campaign of energy service companies, clean energy advocates and property owners in local jurisdictions.

In late February, Arlington County issued a RFP to select a third party PACE program administrator. The creation of a PACE program in Arlington with a third party administrator creates another path forward to advance PACE in Virginia. Other localities can replicate the Arlington model, which calls for a third party to run their program and be paid from origination fees.

Finally, in late March 2016, the Richmond City Council passed a resolution calling for the Chief Administrative Officer to submit a proposal to City Council by January 31, 2017, with recommendations for creating a PACE program. The city is now forming a PACE stakeholder group and will study the Arlington model as part of its work plan to develop recommendations for implementing a PACE program.

Guest Blogger: Abby Johnson, Abacus Property Solutions (VAEEC Member – Individual)

The following speakers provided attendees with an overview of Commercial PACE, including its status across the Commonwealth, case studies, and its value proposition for the area, as well as the development and status of Arlington County’s PACE program:

The following speakers provided attendees with an overview of Commercial PACE, including its status across the Commonwealth, case studies, and its value proposition for the area, as well as the development and status of Arlington County’s PACE program: On November 18th, the Arlington County Board approved the County’s PACE

On November 18th, the Arlington County Board approved the County’s PACE As a part of the

As a part of the

Property Assessed Clean Energy financing, or PACE, is starting to get more and more attention around the Commonwealth and the nation. In fact, Governor McAuliffe and his administration recognized PACE as a viable means to create more jobs, save energy, and lower electricity bills in a recent

Property Assessed Clean Energy financing, or PACE, is starting to get more and more attention around the Commonwealth and the nation. In fact, Governor McAuliffe and his administration recognized PACE as a viable means to create more jobs, save energy, and lower electricity bills in a recent